Reduce your declines

by 50%

Losing too many orders to declined cards?

Our proprietary PayPath™ technology captures every good transaction — and eliminates up to 50% of checkout declines

THE PROBLEM

Declined cards lost orders lost revenue

Did you know?

1 in every 30 online transactions is

declined — for no good reason.

Every day, ecommerce sellers lose thousands of dollars to

declined cards — often, for silly

technical

reasons:

Connectivity issues Outdated card information Errors in verification processes

Banks have their own algorithms for flagging transactions

— and they're very often wrong…

THE TRUTH:

There’s a better way.

Over 10+ years in ecommerce, we’ve discovered proven ways to boost

authorization rates — even when the

bank

says “insufficient funds,” and

even when you get an error message.

Introducing PayPath™

This new, proprietary AI technology — rolled out to our customers by popular demand — uses key strategies culled over 10+ years to prevent faulty error triggers and measurably boost authorizations.

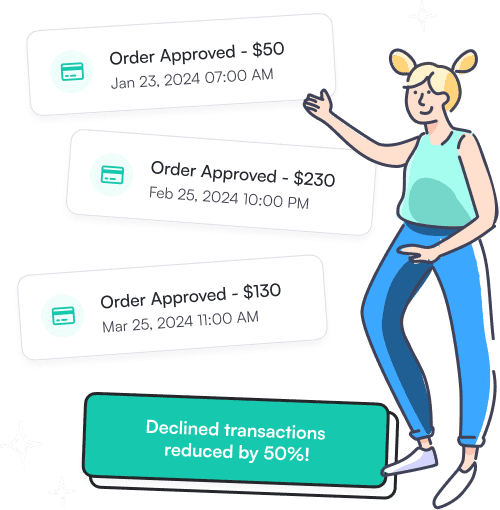

The result?

- Fewer declined cards

- More good orders accepted

- 10% sales increase, on average

“6% revenue increase every month”

We were blown away by the impact of PayPath™ on our bottom line. After implementing the software to improve credit card authorizations, we saw a significant increase in monthly revenue – 6% to be exact!

The ease of use and effectiveness of PayPath™ has been a game-changer for our business.

Joseph

CEO, Little Canadian

How it works

Just 2 simple steps:

Transaction “boosted” instantly

When a transaction is declined, we resubmit it with adjustments within seconds — and most of the time, the charge goes through successfully.

Capture more good orders

Eliminate up to 50% of declines. Stop losing good orders that are this close to transacting successfully.

Does this cost extra?

No, it's baked into the credit card processing fee.

We offer excellent processing rates, and once we're handling your processing, PayPath™ is included. 😊

“Simple, effective, and definitely worth it”

After we started using PayPath™, our monthly revenue increased significantly. The improved credit card authorization process made a noticeable difference, and we're seeing more successful transactions as a result. Simple, effective, and definitely worth it.

Katy

CEO, Valco Baby

Frequently asked questions

Check your rate of declined cards — run a report. Ever see messages like “suspected fraud” “system unavailable” or “contact card issuer”? Many of those are good transactions that didn’t go through the first time around.

If your rate of declined cards is 10% or more, we can help you recapture significant sales every month.

Not necessarily. We've discovered that banks have their own algorithms for flagging transactions —and very often they're wrong. Sometimes it’s simply a technical error (like a slow connection) that causes the problem. If you’re using PayPath™ and the card is declined, you can be assured it’s most likely a true bad transaction — and it was declined for good reason.

PayPath™ comes built-in to our checkout & credit card processing service. Either of those take less than an hour to set up.

We charge a small fixed percentage per order — and this includes 3 full services: checkout, credit card processing, and PayPath™. The percentage is based on your order volume; reach out to us here for an exact quote (we’ll get back to you in 2 hours or less 😊).

The price of PayPath™ is included in Rapid Checkout and our credit card processing — there’s no additional fee on top of our other services.

Don’t let good orders

get away.

There’s a proven way to boost authorizations (and

sales!) and we can make it happen.