How pricing works

Our pricing works on a percentage model.

We take a small percentage of the processing total, which depends on the item list price and volume of sales.

PACKAGES

Protect your store from leaking money

- 100% fraud protection: never pay for fraud again

Optional add-on:

- Chargeback management: We handle all your non-fraud chargebacks too — and win over 75%

- 100% fraud protection: never pay for fraud again

- Rapid Checkout™ to increase conversions (and slash abandonment)

- Credit card processing (with our signature fair prices & fast support)

- PayPath™ to improve credit card authorization rates

- 100% fraud protection: never pay for fraud again

- Rapid Checkout™ to increase conversions (and slash abandonment)

- Credit card processing (with our signature fair prices & fast support)

- PayPath™ to improve credit card authorization rates

- Chargeback management: We handle all your non-fraud chargebacks too — and win over 75%

You might be wondering…

Click the buttons to see the answer:

“Do I really need to pay for fraud protection?”

How much do fraud & chargebacks cost?

A lot more than fraud protection, that’s for sure.

1. Monday morning mishaps

It’s a regular Monday morning at the office, when one of your account managers calls you to his desk. Something in his voice...

It’s a regular Monday morning at the office, when one of your account managers calls you to his desk. Something in his voice makes your stomach drop and your heart rate increase. He shows you a notification of the latest chargeback — $7,500. Seven and a half thousand dollars that will now come out of your pocket. This, in addition to the chargeback you got last week…and the week before that.

Read more2. A tight ship...and money overboard

Next, you decide to take matters into your own hands. You’ve been burned by fraud and you’ve had enough. No more shipping...

Next, you decide to take matters into your own hands. You’ve been burned by fraud and you’ve had enough. No more shipping internationally, no more approving too-expensive orders, no more shipping if the billing info doesn’t match. You haven’t gotten a chargeback in months and all’s good... until you crunch the numbers and realize you’ve lost hundreds of good orders…and thousands of dollars.

Read more3. The low-value hire

You’ve now experienced the danger of fraud firsthand. Looking at the numbers, you realize fraud is costing you too much. So you decide...

You’ve now experienced the danger of fraud firsthand. Looking at the numbers, you realize fraud is costing you too much. So you decide to up your game by hiring a full-time employee to deal with your fraud. They’ve got to be trained now, and you’re worried they’ll make mistakes. Plus, you start wondering whether paying their salary is the best use of your money.

Read more4. Fighting a losing battle

With chargebacks still surfacing despite your efforts, you fight each case, only to realize it consumes a staggering 23+ hours per...

With chargebacks still surfacing despite your efforts, you fight each case, only to realize it consumes a staggering 23+ hours per dispute — time that could be better spent elsewhere. Plus, winning these battles proves elusive, leading to even more frustration and financial setback.

Read more“Our revenue has increased by 5% thanks to Evereye. No one does fraud verification better. They ship out orders we’re not sure about, allowing us to get more sales.”

Adi Shiloach

ShopSmartTVs.com

Thanks to Evereye’s service, I was able to extend into international countries — even into some 3rd world countries — knowing that I am well-protected and insured.

Abe Indig

CEO, Makari de Suisse (Makari.com)

Previously we were canceling about 10% of our orders due to suspected fraud. Now we can just look at Evereye’s report and know what to ship.

Sam

Director of E-Commerce, O5 Group

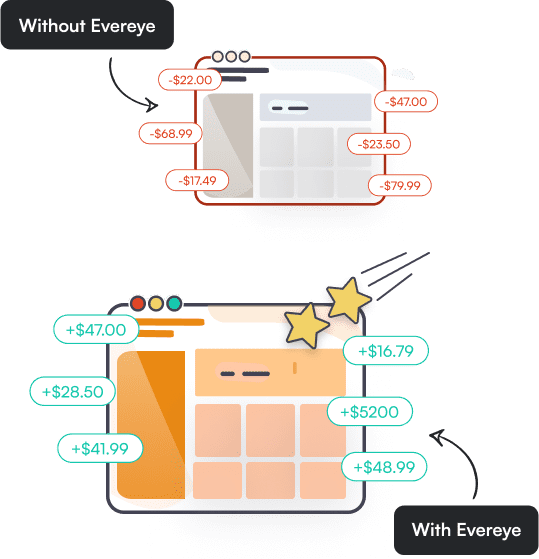

Take a hard look… are you gaining or losing by

fighting fraud on your own?

“Is it really worthwhile to pay for a better checkout?”

How much do bad checkouts cost?

The customers who hit your checkout page are piping-hot 🔥 — about to buy.

But at least 56% of customers never complete the checkout process...often due to clunky UX.

Source: Hotjar

What if you could

slash cart abandonment?

How many more orders could you capture if you used the smartest, fastest checkout on Earth?

“Significant increase in conversion rates”

Cart abandonment was becoming a real problem for our online store. After implementing RapidCheckout™ a few months ago, we saw a significant increase in completed purchases and overall conversion rates.

What really impressed me was Evereye's customer service. When we need help, they respond quickly; actually care about our success, and that makes a big difference.

For any e-commerce business struggling with abandoned carts, I'd recommend giving RapidCheckout™ a try. The return on our investment has been substantial, and implementation was smoother than expected.

John Kindred

CFO Eluktronics

“Am I really losing money to credit card declines?”

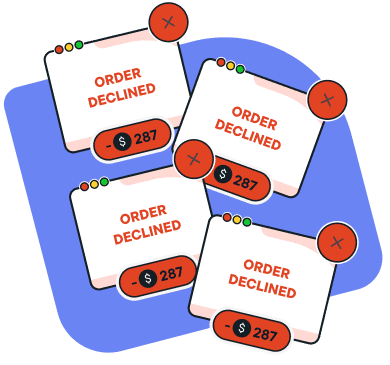

1 in every 30 online transactions is declined — for silly reasons

Every day, ecommerce sellers lose thousands of dollars to declined cards — often, for no good reason:

- Connectivity issues

- Outdated card information

- Errors in verification processes.

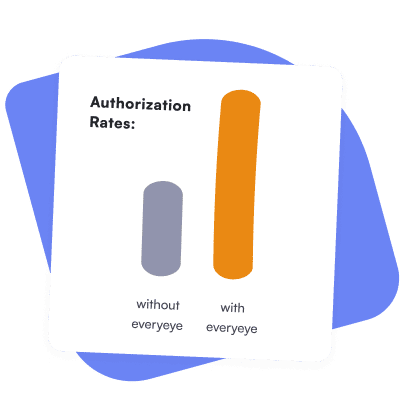

We reduce your declines by 50%

Our proprietary PayPath™ technology captures every good transaction — and eliminates up to 50% of checkout declines.

“6% revenue increase every month”

We were blown away by the impact of PayPath™ on our bottom line. After implementing the software to improve credit card authorizations, we saw a significant increase in monthly revenue – 6% to be exact!

The ease of use and effectiveness of PayPath™ has been a game-changer for our business.

Joseph

CEO, Little Canadian

1000+ ecommerce brands trust

Evereye since 2012

If you’ve had enough and want to keep your money where it belongs, reach out to us here for a custom quote.

A friendly human will contact you within 2 business hours

(yep, hours...not days).